What is Paypal?

Benefits

What is PayPal Payment on Hold?

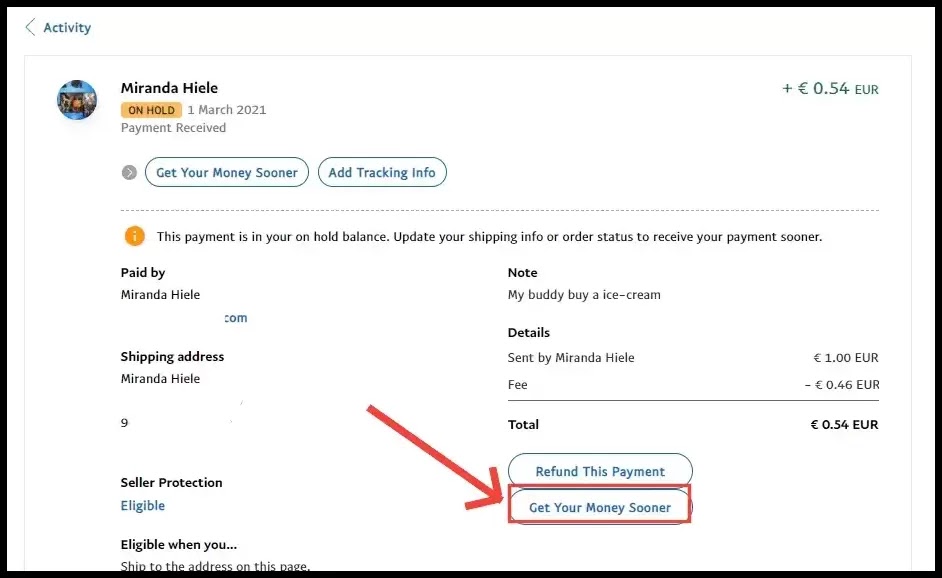

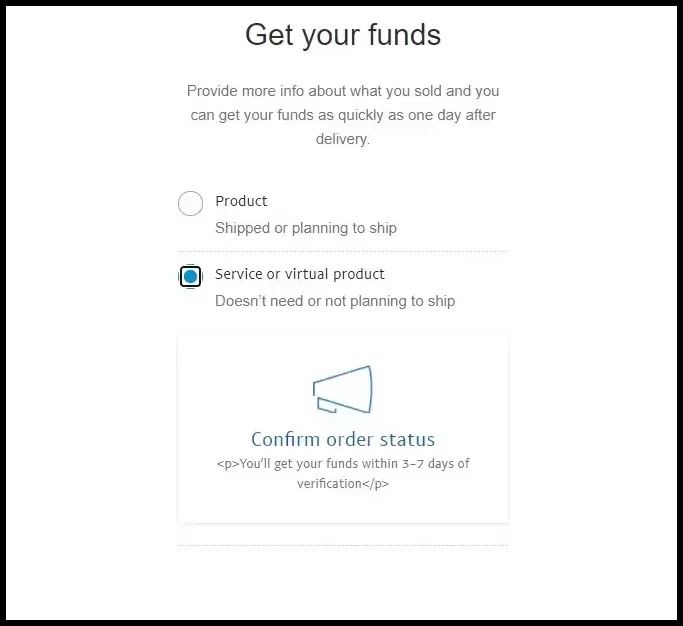

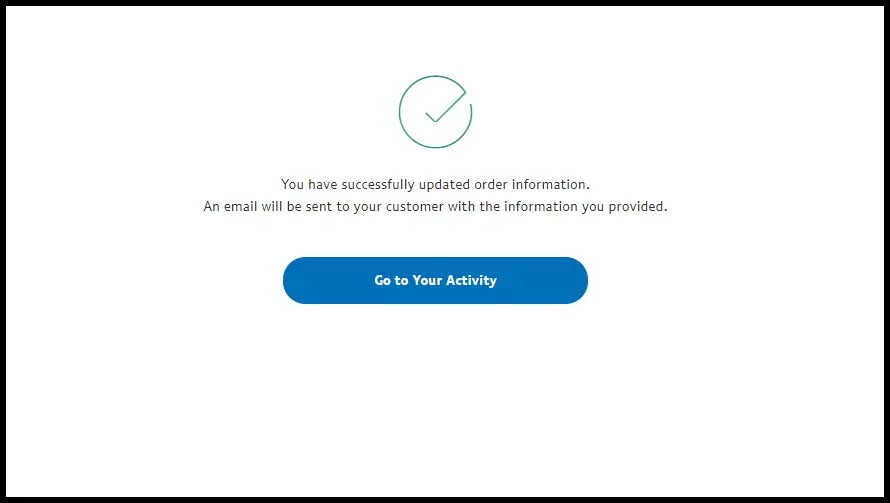

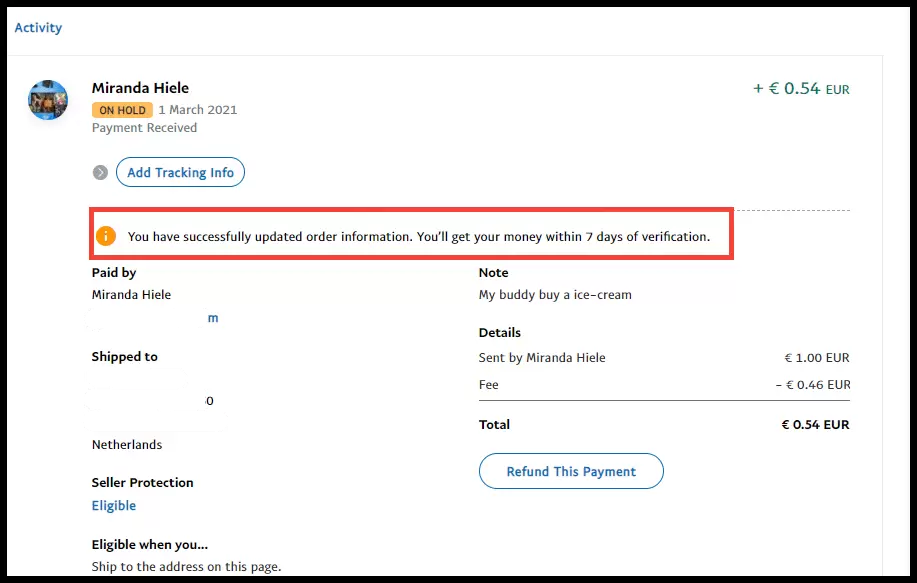

Steps To Fix PayPal Money on Hold.

Definition of PayPal Money on Hold

PayPal Money on Hold refers to the temporary freezing of funds within a PayPal account. This hold typically occurs when PayPal suspects a transaction may be risky or fraudulent, or when there’s insufficient transaction history.

Reasons for PayPal Money on Hold

Insufficient Transaction History

One common reason for funds being placed on hold is a lack of sufficient transaction history. New accounts or those with limited activity may trigger PayPal’s risk management protocols, resulting in funds being held until the transaction is verified.

Suspicious Activity

Transactions that appear suspicious or out of the ordinary can also prompt PayPal to place funds on hold. This could include large or irregular transactions, especially if they deviate from your typical account activity.

High-Risk Transactions

Certain transactions may inherently carry a higher risk of fraud or disputes, such as international sales or high-value purchases. PayPal may opt to hold funds for such transactions to mitigate potential losses.

How to Fix PayPal Money on Hold

Providing Tracking Information

One effective way to expedite the release of funds is by providing tracking information for shipped items. This adds a layer of security and reassurance for both PayPal and the buyer, facilitating a smoother transaction process.

Importance of Tracking Information

- Verification: Providing tracking information allows PayPal to verify that the item has been shipped and is on its way to the buyer. This verification helps reduce the risk of fraudulent claims and ensures a smoother transaction process.

- Faster Release of Funds: With tracking information, PayPal gains confidence in the transaction’s legitimacy, often leading to a quicker release of held funds. This is especially important for businesses that rely on timely access to their funds.

- Customer Assurance: For buyers, receiving tracking information provides peace of mind knowing the status of their purchase and when to expect delivery. It enhances the overall shopping experience and fosters trust in your business.

How to Provide Tracking Information

- Choose Reliable Shipping Services: Opt for reputable shipping carriers that offer tracking services. This ensures that you have access to accurate and up-to-date tracking information throughout the delivery process.

- Upload Tracking Details: Once you’ve shipped the item, promptly upload the tracking details to your PayPal transaction. This can usually be done directly through the PayPal platform or by following the specific instructions provided by your shipping carrier.

- Communicate with the Buyer: Keep the buyer informed by sharing the tracking number and estimated delivery date. Transparency and proactive communication can help prevent misunderstandings and disputes.

- Follow Up: After providing tracking information, periodically check the status of the shipment to ensure it reaches its destination without any issues. In case of any delays or complications, address them promptly and keep the buyer informed.

Verifying Account Details

Ensuring that your account details are accurate and up-to-date can help prevent unnecessary holds. Verify your identity and address within your PayPal account to build trust and credibility.

Importance of Account Verification

- Trust and Credibility: Verifying your account details demonstrates to PayPal that you are a legitimate user with genuine intentions. This enhances your credibility and reduces the likelihood of funds being held for security reasons.

- Risk Mitigation: Accurate account information helps PayPal assess the risk associated with your transactions more accurately. This can result in fewer holds and smoother processing of payments, benefiting both you and your customers.

- Compliance Requirements: In some cases, PayPal may require users to verify their identity or address to comply with regulatory standards or to prevent fraud. By proactively verifying your account, you ensure compliance and avoid potential issues down the line.

How to Verify Your Account Details

- Update Personal Information: Start by reviewing and updating your personal information, including your name, address, and contact details, within your PayPal account settings. Ensure that all information is current and accurate.

- Confirm Bank and Card Details: If you have linked a bank account or credit/debit card to your PayPal account, verify that the details match the information on file with your financial institution. Any discrepancies could trigger security alerts.

- Complete Verification Steps: PayPal may prompt you to complete additional verification steps, such as providing identification documents or confirming your phone number. Follow these steps promptly to verify your account fully.

- Monitor Account Status: After completing the verification process, monitor your account status regularly for any notifications or requests from PayPal. Address any outstanding verification requests promptly to maintain account integrity.

Communicating with PayPal Support

In cases where funds are held, proactive communication with PayPal support is crucial. Provide any requested documentation promptly and clarify any concerns to facilitate a resolution.

Importance of Communication

- Clarity and Understanding: Clear communication helps ensure that both parties understand the nature of the issue and what steps need to be taken to resolve it. By articulating your concerns concisely, you can facilitate a more effective exchange of information.

- Resolution Assistance: PayPal support representatives are there to help you navigate through any issues you encounter. By communicating your situation and providing relevant details, you enable them to provide targeted assistance and solutions tailored to your needs.

- Timely Updates: Keeping the lines of communication open ensures that you receive timely updates on the status of your case and any actions required on your part. This allows you to stay informed and proactively address any outstanding issues.

Tips for Effective Communication

- Be Clear and Concise: When reaching out to PayPal support, clearly state the nature of your issue and provide any relevant details or documentation upfront. Avoid unnecessary jargon or ambiguity to facilitate a smooth exchange of information.

- Provide Relevant Information: Include transaction IDs, account details, and any other pertinent information that can help PayPal support understand the context of your inquiry. This streamlines the support process and expedites resolution.

- Be Polite and Respectful: Maintain a professional and courteous tone in all communications with PayPal support representatives. Even if you’re frustrated or displeased with the situation, maintaining a respectful demeanor fosters a more positive interaction.

- Follow Up as Needed: If you haven’t received a satisfactory response or resolution from PayPal support, don’t hesitate to follow up on your inquiry. Polite persistence can sometimes lead to a quicker resolution or escalation to higher levels of support.

Resolving Customer Disputes

Promptly addressing customer disputes and inquiries can prevent escalations that may lead to funds being held. Keep lines of communication open and strive to resolve issues amicably.

Importance of Resolution

- Maintaining Customer Relationships: Resolving disputes in a timely and satisfactory manner is essential for preserving positive relationships with your customers. Addressing their concerns demonstrates your commitment to customer satisfaction and can turn a negative experience into a positive one.

- Avoiding Escalations: Unresolved disputes can escalate, leading to negative feedback, chargebacks, or even legal action. By proactively addressing customer concerns, you can mitigate the risk of escalations and protect your reputation and finances.

- Facilitating Fund Release: Resolving disputes often involves providing evidence or documentation to PayPal to support your case. By doing so, you increase the likelihood of Paypal Money on hold releasing the held funds sooner, minimizing disruptions to your cash flow.

Tips for Effective Resolution

- Listen Actively: Start by listening to your customer’s concerns attentively and empathetically. Let them express their grievances without interruption, and assure them that you’re committed to finding a resolution.

- Acknowledge Their Concerns: Validate your customer’s feelings and concerns, even if you disagree with their perspective. Acknowledging their feelings can help defuse tension and open the door to constructive dialogue.

- Offer Solutions: Propose practical solutions to address the customer’s concerns and resolve the dispute amicably. This could involve offering a refund, replacement, discount, or other forms of compensation to remedy the situation.

- Provide Clear Communication: Keep the customer informed throughout the resolution process, providing updates on any actions taken or progress made. Transparency and communication build trust and confidence in your ability to resolve the issue.

- Document Everything: Maintain thorough records of all communication with the customer, including emails, messages, and phone calls. Documenting the resolution process can provide evidence to support your case if needed.

Avoiding Risky Transactions

To minimize the likelihood of funds being held, exercise caution when engaging in high-risk transactions. Conduct due diligence on buyers or sellers, and avoid transactions that seem suspicious or risky.

Importance of Risk Management

- Protecting Your Finances: Avoiding risky transactions Paypal Money on hold helps safeguard your financial resources from potential losses due to fraud, chargebacks, or disputes. By being vigilant, you can protect your bottom line and maintain a healthy cash flow.

- Preserving Your Reputation: Engaging in risky transactions can tarnish your reputation and erode trust with your customers and PayPal. By demonstrating a commitment to safe and secure transactions, you reinforce your reliability and credibility as a business owner.

- Minimizing Disruptions: Risky transactions are more likely to trigger holds or delays in accessing your funds. By steering clear of such transactions, you can avoid disruptions to your cash flow and ensure smoother financial operations.

Tips for Avoidance

- Conduct Due Diligence: Before engaging in any transaction, thoroughly research the buyer or seller to verify their legitimacy. Check their reputation, reviews, and transaction history to assess the risk involved.

- Use Secure Payment Methods: Whenever possible, opt for secure payment methods that offer buyer and seller protection, such as PayPal’s goods and services option. Avoid accepting payments via methods that lack safeguards against fraud or disputes.

- Set Transaction Limits: Consider setting limits on the size or frequency of transactions to minimize exposure to risk. This can help prevent large or irregular transactions that may raise red flags for PayPal or indicate potential fraud.

- Require Verification: For high-value transactions or purchases from unfamiliar customers, consider requiring additional verification steps, such as identity verification or proof of address. This adds an extra layer of security and reduces the risk of fraudulent transactions.

- Trust Your Instincts: If a transaction seems too good to be true or raises suspicions, trust your instincts and proceed with caution. It’s better to err on the side of caution than to expose yourself to unnecessary risk.

Common Mistakes to Avoid

Ignoring PayPal Notifications

Ignoring notifications or requests for information from PayPal can exacerbate the situation and prolong the hold period. Stay vigilant and respond promptly to any communications from PayPal.

Not Verifying Customer Information

Failing to verify customer information or shipping details can raise red flags for PayPal. Ensure that all transaction details are accurate and legitimate to avoid triggering holds.

Neglecting Communication with PayPal

Lack of communication or transparency with PayPal can hinder the resolution process. Stay proactive and engaged, providing any necessary information or documentation as requested

FAQs

How long does Paypal Money on hold? PayPal typically holds funds for up to 21 days but may release them sooner if certain criteria are met.

Can I expedite the release of funds? Yes, providing tracking information and maintaining open communication with PayPal can help expedite the release of funds.

What if I don’t have tracking information? If tracking information is unavailable, ensure that you communicate with PayPal and provide alternative documentation to verify the transaction.

What happens if I don’t resolve customer disputes? Failure to resolve disputes in a timely manner may result in funds being held for an extended period or returned to the buyer.

Is there a way to prevent money from being held on PayPal? While holds are sometimes unavoidable, maintaining a positive transaction history, verifying account details, and avoiding risky transactions can help minimize the likelihood of funds being held.

Conclusion

Encountering PayPal Money on Hold can be daunting, but with the right approach, it can be resolved efficiently. By understanding the reasons behind holds, communicating effectively with PayPal, and avoiding common pitfalls, you can ensure smoother transactions and maintain trust with your customers.